Magistrates heard this week how a driver failed to see the cyclist waiting in the middle of the road to make a turn – only becoming aware of the cyclist’s presence when he was sent flying over the windscreen leaving him with injuries requiring four days in intensive care.

District Judge Stephen Nicholls described the incident as a “momentary lapse of concentration” on the part of the driver as he fined him £350 and handed him three penalty points.

The case prompted Ian Austin MP to Tweet that the sentence was a farce. We think it’s even more ridiculous that our members of our Parliament appear impotent to change the legal framework that underpins the culture of our roads. Parliamentary Under Secretary of State for the Department for Transport Jesse Norman assures us that the forthcoming review of road traffic law and sentencing will improve conditions for all road users and yet over recent months has seemed curiously preoccupied with the threat posed by cyclists.

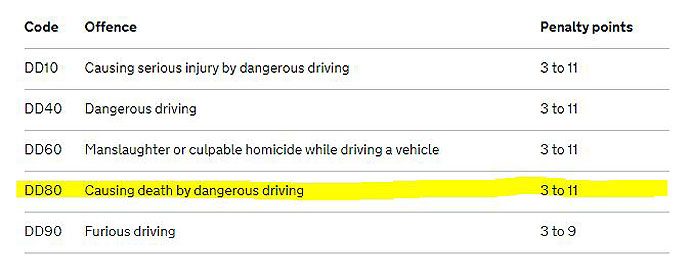

Britain is in dire need of a complete overhaul of road traffic law and sentencing – not least because of the current lack of consistency. The driver mentioned in the case above was handed three points. Three points is at the lower end of the tariff for the offence of causing death by dangerous driving and yet driving without insurance carries a minimum penalty of six points.

While he is getting the penalty tariffs in order, Jesse Norman should strict liability – a law that makes the insurers of motorised vehicles automatically liable for injury caused to vulnerable road users. Britain is one of the few European countries that refuses to implement strict liability – little wonder our roads can feel like the wild west for the most vulnerable.

Vision Zero

The single most meaningful thing our roads minister could do to improve the roads for everyone – irrespective of the way they travel – is to introduce the systematic approach to road danger reduction seen in the Netherlands and Sweden. It’s a policy that seeks to eliminate completely deaths on the road, which is why it is sometimes referred to as Vision Zero. We are already many decades behind our European cousins. Rather than describe our road traffic law as a farce, our MPs muct take action now.

Ethical insurance

The ETA has been voted Britain’s most ethical insurance company 2017.

The Good Shopping Guide each year reveals the good, the bad, and the ugly of the world’s companies and brands, with a view to supporting the growth of social responsibility and ethical business as well as a more sustainable, just society.

Beating household-name insurance companies such as John Lewis and the Co-op, we earned an ethical company index score of 89 – earning us joint-first place with Naturesave.

Your Journey Our world

The ETA was established in 1990 as an ethical provider of green, reliable travel services. Twenty seven years on, we continue to offer home insurance, cycle insurance, travel insurance and breakdown cover while putting concern for the environment at the heart of all we do.

eddie white

The one change to the law we must make, apart from vision zero is to implement strict liability. Put an end to the way insurance comp’s act in the UK, ( not ETA ) this would clip there wings at a stroke, because it’s not just the drivers at fault