A driver with 12 penalty points gets an automatic ban, right? While that’s the theory, in practice magistrates are easily persuaded to overlook a ban in favour of simply adding more points.

Around 8,000 drivers continue to drive legally despite having accrued more than 12 penalty points. Every day, careless and dangerous drivers are stopped by the police and prosecuted by the Crown Prosecution Service (CPS), but then treated so leniently by magistrates that they continue to offend – thereby causing further work for the police, not to mention a continuing peril to other road users. Drivers with 12 penalty points are ordinarily required by law to be disqualified for at least six months or more by the courts.

One driver racked up a total of 62 penalty points on his licence for speeding without a ban being imposed.

Clearly it’s not the responsibility of motor insurers to provide a de facto enforcement of road traffic law, but why do they provide cover for drivers with 12 or more penalty points?

Join the debate on Twitter…

Why do motor insurers offer cover to drivers with 12+ penalty points?

— ETA Services Ltd (@ETAservicesltd) March 10, 2022

It’s another example of the questionable ethics of which most customers are unaware.

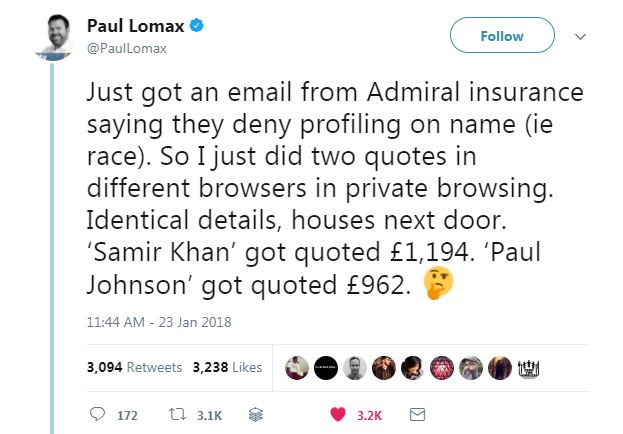

Admiral was one of a number of car insurers in 2018 to be embroiled in allegations of racial profiling – journalists uncovered that drivers with an Arabic name were being charged hundreds of pounds more than other customers identical in all but name.

Churchill may have a friendly looking British Bulldog as its mascot, but it seems the creature is as likely to snarl rabidly as it is to chortle if the legal case brought by the insurance giant in 2013 is anything to go by.

In a bid, one assumes, to protect its bottom line on behalf of its customers, Churchill insurance appealed against the High Court ruling that ordered it pay £5m compensation to a 13-year-old girl who was left brain-damaged after she was run over by one of its customer who was speeding at the time.

Bethany Probert was walking on a grass verge when she was struck by the car, but the insurer claimed she was partly to blame because she was not wearing a high-visibility jacket at the time.

When the case was heard in the High Court, the judge ruled that the insurance company was 100 per cent liable because the driver was speeding. However, the insurers appealed against the original ruling. The plan, it seemed, was for Churchill’s lawyers to argue Bethany should have known to wear reflective clothing because she was an experienced horse rider.

At the time the Churchill insurance spokesperson said: “While we accept that our insured was liable in part for the accident, we are appealing the decision that he was entirely to blame.”

Had the appeal been heard, the test case would have established to what extent children can be held responsible for their injuries in road crashes. However, as is often the case, and completely understandably given what they had already endured, Bethany’s beleaguered parents accepted a reduced out-of-court settlement.

We’re not sure whether or not there’s such a thing as ethical motor insurance – we often have to fight with them tooth and nail when we’re seeking compensation on behalf of our cycle insurance customers ( even when their driver is bang to rights) so we’d be interested to hear from any that feel they are.

The ethical choice

The ETA was established in 1990 as an ethical provider of green, reliable travel services. Over 30 years on, we continue to offer cycle insurance , breakdown cover and mobility scooter insurance while putting concern for the environment at the heart of all we do.

The Good Shopping Guide judges us to be the UK’s most ethical provider.

John Fletcher

It’s outrageous, and I for one will add Churchill to my list of companies to be completely boycotted. It’s the only thing they understand.

Chris

Allowing drivers to legally drive with 12 penalty points or more must surely undermine the argument that the effect of road traffic laws is to improve road safety. These repeat offenders are habitual law breakers. Some repeat offenders who plead exceptional hardship don’t modify their driving and go on to kill. [Christopher Gard]

The exceptional hardship clause needs to be truly exceptional, at the moment it is far from exceptional. Cycling UK produced this report: FIVE FLAWS: FAILING LAWS – How and why the Police, Crime, Sentencing and Courts Bill must tackle five failings of road traffic law in Great Britain

I have been driving since August 1984, that’s 37 years 7 months. I have never had any penalty points, nor any need to claim exceptional hardship.